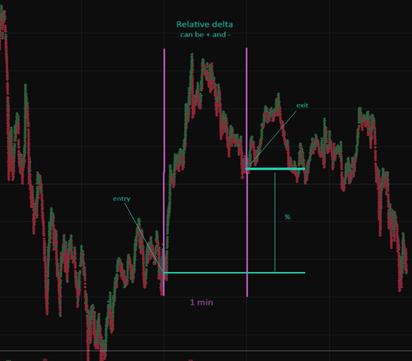

General concept: this algorithm is created and designed for its users to profit from sudden price movements, which are usually triggered by actions performed by either a single person or a group of people who own a significant amount of a certain asset, working together in an organized manner, throwing the asset into the market at the market price in a lump sum. You will be able to see sudden spikes or dips on the chart while the overall trend continues according to the established trend.

Take a look at the example below:

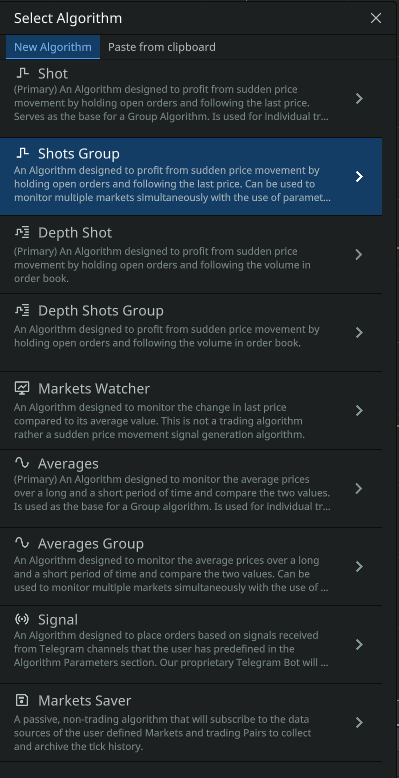

Add a new algorithm by clicking the «Add Algorithm» button on the «Algorithms» tab. The following pop-up window will appear:

The user can choose between SHOT and SHOT GROUP algorithm. The first one runs the algorithm for one trading pair, the second one — for several trading pairs or the whole market.

Consider SHOT GROUP:

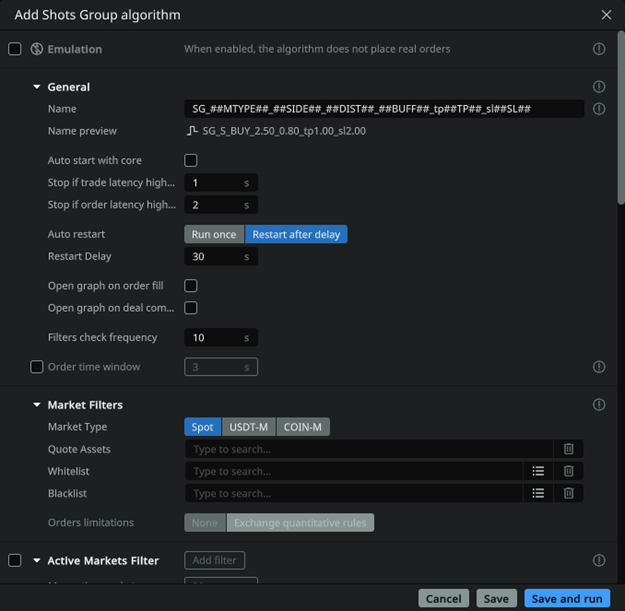

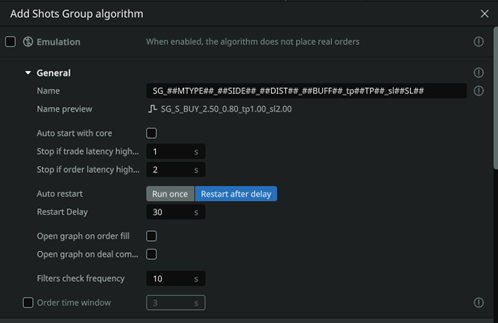

General settings

- Emulation: if the checkbox is checked, the algorithm works in the «emulation» mode, without placing orders to the exchange. (In this mode, the commission is not taken into account in the reports, you need to calculate it yourself for analysis)

- Name: specify the name of your algorithm to easily identify it in the full list of algorithms. For convenience, you can specify parameters in the name, for example, «2.5-long». Or use the formulae for auto-generation of the name based on the algorithm parameters.

- In the Name preview field, you will see the final name of the algorithm

- Auto start with core: the checkbox allows the user to select whether the algorithm will start automatically after the core starts.

- Stop if trade latency is higher than: will stop the algorithm (and cancel its orders) if the transaction latency exceeds this value. Specified in seconds. 1 second = 1000 ms delay.

Stop on trade latency. It is recommended to use a small value (1-5 seconds) to stop the algorithm as soon as a delay in the input of stock data is noticed. This is an additional protection against lags on the exchange side, which can cause unwanted order fills. In low liquid spot markets, as well as long distances, you can increase this parameter and thus disable the autostop, specifically to keep trading when the market is chaotic.

- Stop if order latency higher than: will cancel the placing of an order if for any reason it takes longer to place (or cancel) than the time specified in this setting in seconds.

- Auto restart: allows you to allow or disallow the algorithm logic to run automatically if a previously placed order has been executed.

- Restart delay: delay of the algorithm from re-triggering. In seconds.

- Open graph on trigger: theon/off switch allows the user to open a chart to the screen when an order is filled on this strategy.

- Filter check frequency: time in seconds, how often the algorithm checks the values of current deltas on the market. For «slow» algorithms, it is desirable to query deltas less frequently to reduce the load on the core.

- Order time window: sets the time period in seconds within which a request is valid for processing by the exchange. If for any reason the request is sent with a delay or the exchange takes a long time to process it and does not fit within the specified time frame, the exchange itself will cancel the request.

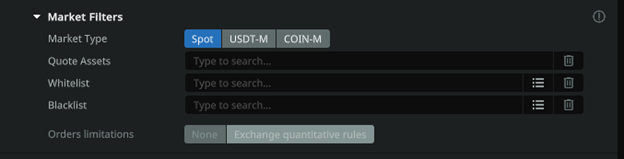

Market Filters

Market Type: allows the user to select the desired market type for trading: Spot/Futures/Delivery.

Quote asset: determines the quoted asset (For example usdt or btc). If you want to trade the entire market to Tether currency, specify usdt and press Enter.

White list: currency pairs of the «white list». If you fill this field, you should leave the item «Combined by Quoted Pair» empty! Suppose you want to trade only two pairs BTCUSDT and ETHUSDT, then specify them in this field separated by commas. Trading on other pairs will not be performed. Format — btcusdt, ethusdt, etc.. Followed by Enter key on the keyboard

Black List: currency pairs of the «black list». Let’s assume that in the field «Quote Assets» you specified the quoted asset usdt, but you do not want to trade on currency pairs BTCUSDT and ETHUSDT, then specify them separated by commas in the Blacklist field. Format — btcusdt, ethusdt, etc. Followed by Enter key on the keyboard

Orders limitations: Exchange Quantitative Rules (Binance only) includes protection against banning under the quantitative rules category. Read more on the Binance website: https://www.binance.com/ru/support/faq/4f462ebe6ff445d4a170be7d9e897272.

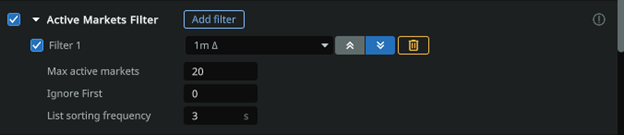

Active markets filter

Set a clear limit on the number of markets for the algorithm. It helps to correctly calculate the resources used for an algorithm that has more markets passing through the global filters than necessary. Set the principles for sorting the list of markets to select from a larger number of markets. The result of this Filter and the sorting principle will be a limited list from which markets will be pushed out and added over time, and the algorithm will start or stop accordingly. The List sorting frequency parameter allows the user to set the time in seconds for the list to be updated by pairs based on global filters, which allows a pair to enter or leave the list, as well as the sorting order (ascending or descending). The Ignore First parameter allows users to start placing orders in the sorted list from any position (if 0 is left, it will start from the first position of the list). Example: In global filters the quota market USDT is specified, the list of 100+ markets is obtained, you want to trade only on the 10 most volatile ones for the last hour, then «Max active markets» = 10 and the sorting principle «1h descending» is specified.

- Max. active markets: it isrequired to specify the maximum number of markets in the filtering list. For example, if you will filter by delta in descending order, and you specify 10 markets, then there will be conditionally TOP 10 with the highest delta.

- Ignore first: thenumber of markets that are the first in the generated list to be ignored. For example, when forming by volume, you do not need BTC, which often tops the list by this criterion.

- List sorting frequency: specify the list update frequency in seconds. Note: this parameter will sort the list that is formed by all trading pairs that have passed the global filters. How often the global filters are applied to the pairs you specified for use by the algorithm is determined by the «Filter check frequency» in the General section.

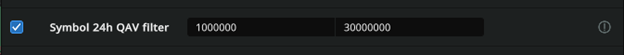

- Filter 1,2,3-…: set of filters (you can add any number of filters via the «Add filter» button). Currently you can filter by absolute deltas or relative deltas from 5s to 24h and by per 24 hours Quote asset volume (24h QAV).

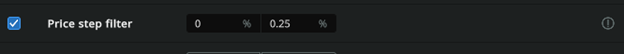

Price step filter

- Range: (from and to, in absolute value) sets the interval for the algorithm for the price step as a percentage of the current price (if the price step is less or more than this percentage, the order will not be placed).

It is used to cut off «square» coins from trading, on which the price step can reach up to several percent.

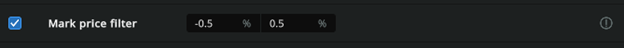

Mark price filter

- Range: sets the algorithm the interval of deviation of the mark price from the current market price (in percent) within which the order will be placed. IMPORTANT: you can set both negative and positive values. Orders will be placed as long as mark price is within the specified range.

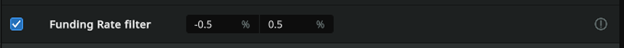

Funding rate filter (funding)

Specify the range of the funding rate in which the algorithm will work.

Example (screenshot above): the algorithm will place orders only on coins that have a funding rate between -0.5% and 0.5%

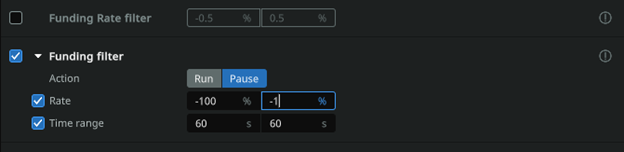

Funding filter

Specify the range of the funding rate and the time BEFORE the funding rate payment at which the algorithm will start or pause and the time AFTER the funding rate payment at which the algorithm will start or pause again, depending on the «Action» parameter

Example (screenshot above): trading will be stopped one minute before the funding rate is paid only on those coins whose funding is in the range of -100% to -1% and will start again one minute after the rate is paid.

(Read more about the financing rate: https://www.youtube.com/watch?v=4vzkgi_7knA )

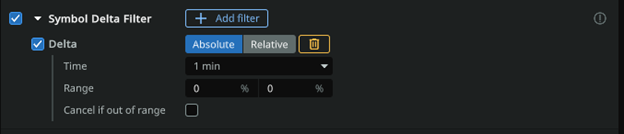

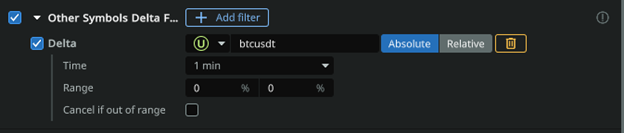

Symbol Delta Filter

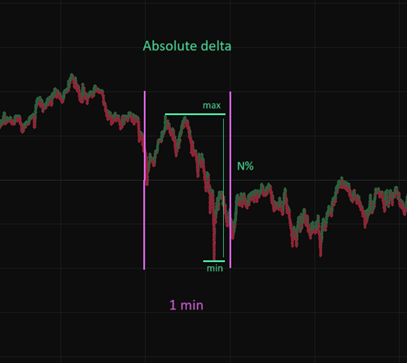

Enables/disables delta filters for each coin for which the algorithm is configured to place orders. This option allows you to add one or more filters, which can differ by time interval and delta range. The delta range can be relative (if values are entered with a «-» sign) or absolute (values are entered as positive integers) and must be entered from smaller (left field) to larger (right field).

Use absolute or relative delta: deltas must be specified in the «range» field. Absolute delta can only have positive values. When using Relative delta, the values can be negative, e.g. from -1.5% to -0.5%

- Time : timeinterval of the delta, currency pairs (which will be selected given the quoted currency, «white list», «black list» data). You can choose one of the proposed options. In the future, the limits of the minimum and maximum delta of markets will be based on this interval.

- Range: Specify the range of the minimum and maximum delta. From N1% to N2%. If the delta of the asset is outside the selected range, the algorithm will not work and orders will not be placed. For example, if you have chosen a time period of 5 minutes and specified a range from 0.5% to 2%, the algorithm will work only on those pairs where the price has changed not more than 2% and not less than 0.5% in 5 minutes — price direction is not important. The values are positive only. You can view the deltas in the client — tab «Market Live».

- Cancel if out of range: if checked, orders in this algorithm will be canceled when deltas leave the selected range.

Note: youcan add multiple filters with deltas of different types.

Symbol Quote Asset Value (QAV) filter

- Range: specify the range of minimum and maximum volume for 24 hours, currency pairs (which will be selected taking into account the data of the quoted currency, «white list», «black list»). If the volume of the selected currency pair is less than the set value in the first field or higher than the value in the second field, the algorithm will not work and orders will not be placed. You can view the volumes in the client — «Market Watch» tab.

Delta filters on the selected market

- Trading pair: allows selecting anytrading pair, from various Markets (Spot/Futures) relative to the deltas of which the filter will be used. For example, Sport BTCUSDT.

- Time: the time interval of the BTC currency delta. You can choose one of the proposed options. In the future, the minimum and maximum BTC delta limits will be based on this interval.

- Range: Specify the range of minimum and maximum BTC delta. From N1% to N2%. If the delta of BTC is outside the selected range, the algorithm will not work and orders will not be placed on the selected pairs. The values are positive only. You can view BTC deltas in the client — «Market Live» tab.

- Cancel if out of range: if checked, orders in this algorithm will be canceled when deltas move out of the selected range.

Performance Filter: Allows the user to customize the performance of the current algorithm based on the trading results of all running algorithms, a specific trading pair, the current algorithm or any other algorithm.

For more details, please refer to the instructions

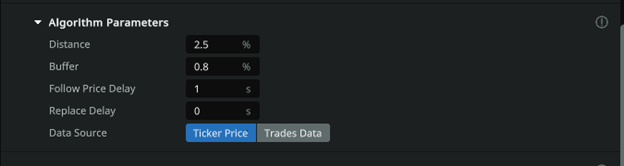

Algorithm parameters

- Distance: how far from the current price (in percent), an order should be placed by the algorithm.

- Buffer: the area in which the price is free to fluctuate without causing a change in the position of the order placed by the algorithm is also set as a percentage (of the current price) and DIVIDED BY 2 , which means that half of the set value will be the upper buffer zone (above the price) and half will be the lower buffer zone (below the price).

- Follow Price Delay — sets the delay in seconds until the expiration of which the order will not follow the price.

- Replace Delay — sets the delay in seconds until the expiration of which the order will not move AWAY from the price.

- Data source: datasource Ticker is less resource-intensive, but slower and less sensitive (one update per 0.5 seconds). It is recommended for a large number of orders with a distance of 1% or more. Trades data source is more resource-intensive, which affects the stable work of a large number of orders, but it is faster, price updates are received with every new appearing trade. Recommended to use only for close distance.

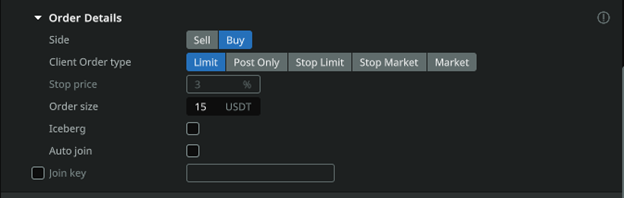

Order parameters

- Side: allows the user to select which type of order to place to the algorithm Buy (Long) or Sell (Short).

- Client Order type: sets the type of order to be placed by the algorithm. You can read more about the order type in the documentation of the Exchange itself.

- Stop Price: sets a certain distance from the price level at which the Stop Limit Order is placed to the price that triggers the Stop Limit Order.

- Order size: ordervalue set in USDT. This value takes into account the leverage of users. For example, for trading on the BTCUSDT pair, the minimum order is 0.001 BTC, at the price of BTC 45000$ will be equal to 45$. It is necessary to specify from 45, this value will already be leveraged, i.e. with a leverage of x125 — your funds will be involved 0.36$. Try to specify a little higher than the minimum value for correct execution of the order.

- Iceberg: when activated, hides the true order size by buying/selling with smaller and equal volumes. Allows the user to hide large volume orders in the order book. Enabled separately for new orders and Take Profit orders.

- Auto join: the filled orders of the algorithms will be joined together, thus shifting the average entry point. After the orders are joined, the distance to the TP/RL will be updated relative to the average price.

- Join Key: Used to join positions of different algorithms. If enabled, all positions with the same key will be joined.

Note: In order to combine orders exclusively within one algorithm, it is necessary to check the Auto join checkbox and set the join key.

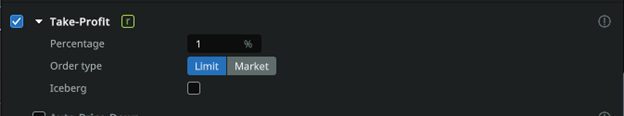

Take profit

- Percentage: sets the distance from the price (at which the order was executed) to Take Profit as a percentage.

- Order Type: sets the type of Take Profit order to be placed by the algorithm. You can read more about the order type in the documentation of the Exchange itself.

Auto price down

- Timer: sets the delay in seconds until the Take Profit starts to decrease to the current price (the same value will be used for both the first step and all subsequent steps).

- Step: sets the percentage value of the Take Profit approach step to the initial price.

- Limit: sets the lowest limit, as a percentage of the initial order, to which Take Profit will drop and stop.

Stop loss

- Percentage: sets the distance from the price (at which the order was executed) to the Stop Loss as a percentage.

- Spread: determines the additional distance from the Order Book spread where the Limit order will be placed to ensure execution once the price reaches the Stop-Loss level

- Delay: Thedelay of placing a Stop Loss in seconds, after the original order is executed.

- Order type: sets the type of Stop Loss order to be placed by the algorithm. You can read more about the order type in the documentation of the Exchange itself.

Trailing stop

- Spread: value in percent of price movement, in the profitable direction from the initial price, after traveling which, the Stop Loss will be placed at the distance specified in the parameter «Stop Loss -> Percentage», calculated from the new current price.

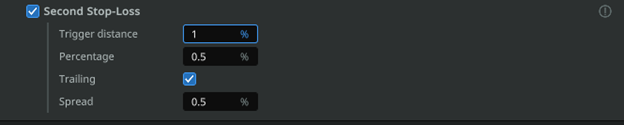

Second Stop Loss

Enables/disables a special Stop Loss function that cancels the original Stop Loss and places a new one after the price moves in a profitable direction relative to the side of the position by a certain amount. Thus, if the function is enabled, the second Stop Loss will cancel the initial Stop Loss and, once price reaches the distance of the second SL trigger, place a new Stop Loss at a distance from this level equal to the distance of the second SL. For example: if the trigger of the second SL is 0.5% and the percentage of the distance of the second SL is 0.2%, then once price reaches the second SL’s trigger of 0.5%, the second Stop Loss will be placed at a distance of 0.3% (0.5% — 0.2%). The second SL can also be assigned a trailing function that will allow it to track the current price at a distance equal to the trailing spread (similar to the trailing function of the initial stop loss).

- Trigger distance: a value in percent of price movement, when reached, the trigger will work and set a new Stop Loss (by the specified percentage of the «Second Stop Distance» parameter) to replace the first one. This parameter can be used to move the Stop Loss to breakeven, when reaching half of the distance to Take Profit.

- Percentage: the distance in percentage from the price at the moment of triggering the «Second Stop Trigger» to the new Stop Loss, replacing the old one.

- Second Stop Trailing: enabling the option — Trailing SL (following the price) for the second Stop Loss.

- Trailing Stop Spread: value in percent of price movement, in the opposite direction from the initial price. At which Stop Loss will follow the current price by the specified distance in the parameter «Second Stop Loss -> Percentage».