Jump to: Part 1, Part 2, Part 3, Part 4, Part 5, Part 6, Part 7, Part 8, Part 9, Part 10, Part 11, Part 12, Part 13. Part 14.

Running The Margin Blade – The Oblivion Or High Heaven Of Trading

Risk is the inherent factor of any type of trade. Fortunes have been made and lost on trade in stocks, bonds, commodities, cryptocurrencies and even empty promises. The reason for such tribulations in trading is the fact that traders are obliged by a set of rules established on almost every trading platform known to man, to put forward a certain amount of funds to prove that they are capable of buying a certain asset. Far too often, the players of the trading market do not have enough collateral to buy an asset that they wish to trade. This is where a strategy known as margin trading comes into play.

For any aspiring, budding, young trader seeking to make a fortune by trading stocks or cryptocurrencies, the term margin trading may well be scary, like most other slang expressions and terms inhabiting trading platforms. But once examined under the prism of common sense and provided a good explanation, margin trading turns out to be nothing more than a common, household name.

Edging Up On The Margin

Margin trading can be simply described as taking a loan. In trading practice, things are a bit more complicated, but the essence remains largely parallel to that of its ordinary counterpart that may be carried out even between friends. First and foremost, given the high risk that it bears, margin trading can only be carried out via a special account called a margin account. Since margin accounts can be opened only by brokers, and it is brokers who provide the margin, or loan, the broker will require the client’s signature to open an account and an amount of no less than $2,000 by law on regulated classical exchanges. Such deposits are known as minimum margins and allow the trader to purchase up to 50% of the initial price of the asset they wish on margin, or using the loan, in other words.

Just like every other loan, margins can be kept for as long as the trader wishes, so long as they eventually repay the amount they borrowed in full. But restrictions also exist in the form of something called a maintenance margin. This is the bare minimum account balance that traders must have on their accounts. That amount is for the broker’s security to make sure they get repaid. If that minimum falls below a set level, the broker will have every right to force the trader to top up the balance or even sell the assets purchased on margin to repay their debts. Such a situation is known as a margin call.

Naturally, not everything can be bought on margin. It is common practice for brokers not to give out margins on over-the-counter Bulletin Board (OTCBB) securities, penny stocks, or initial public offering stocks (IPOs), since the risk they carry and the volatility inherent to them is high. Individual brokers have the right to set their own rules on what to issue margins for and what not to.

Given the multitude of nuances involved in margin trading, their statistics are being tracked in real time. The New York Stock Exchange (NYSE) is responsible for tracking the total amount of margin debt in the world. Such statistics are necessary because of the high risk that margin trading bears and the influence it may have on the global economy at large. If the amount of margin trading exceeds acceptable levels, the exchanges can put a stop to trading to reduce volatility.

More important in margin trading is the human factor, since many traders overestimate their financial capabilities regularly and incur losses. As a result, only very advanced and highly skilled traders partake in margin trading. An important factor in deciding whether to trade on margin is the availability of sufficient collateral that would allow the trader to cover their debts and, preferably, avoid total financial ruin, misery and despair.

Exchanges that support margin trading include Binance, Bittrex, BitMex, OKCoin and others. The leverage and margin differences are very stark, as every platform considers its own levels of margin trading and decides its own amount of trust in its participants. On Binance, for instance, the amount of margin allowed to a trader is determined by their Tier level. The higher the Tier, the higher the margin allowed, but it will never exceed 2x of the amount in your margin wallet.

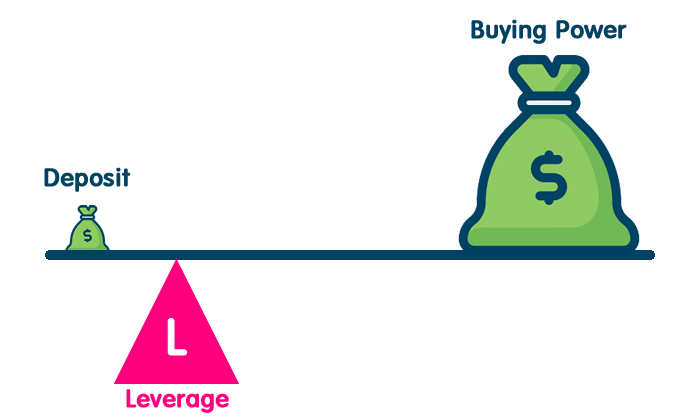

To illustrate the destructive and return-generating power of margin trading, it is best to take an example. For instance, a trader decides to deposit $10,000 on a margin account that he has opened with a broker. The trader places 50% of the purchase price of the asset he wishes to buy. By doing so, the trader has generated an additional $10,000 as a loan, or margin, and now has $20,000 of purchasing power to conduct his trading activities.

If this trader decides to buy $5,000 worth of some asset or stock, $15,000 will remain on his account and will still be considered as remaining purchasing power. The trader still has enough money to cover his transactions and to repay the broker. If the trader decides to buy stocks for $15,000, then he will be tapping $5,000 from his margin, meaning he will be in debt to the broker in the amount of $5,000.

If the trader’s asset suddenly jumped in price, then he has made money and can reap the returns. But if we suddenly consider the case of the asset’s price dropping from $15,000 to $5,000 for some catastrophic reason, our trader is now in serious trouble, since he is now indebted to the broker for $10,000, and it is his problem how to cover such losses.

The Pros And Cons Of Margin Trading

After having read everything said above, the reader will have probably already formed a sufficiently realistic picture of the risks involved in margin trading.

The main advantage that margin trading grants to all who resort to it is the provision of liquidity that traders may not have to engage in trade with assets of interest to them at that moment. The availability of liquidity allows traders to buy assets and trade, just like any other loan in the world would allow the borrower to do what they please with the money. Margin trading allows for generating returns without being hindered by the lack of available liquidity. The returns involved may be very high, all depending on the trader’s skills, strategy, approach, caution and market conditions.

The risks, however, are also just as high. The main risk resides in the potential price drop of the asset that was bought on margin. If the asset loses its value, the trader will be indebted and will suffer losses, since they may not have enough funds or collateral to pay for the margin. Risk is inherent in debts, especially when these debts are being used to purchase assets.

With cryptocurrencies the risk factor is exacerbated by their inherent volatility. True, volatility can be bipolar and can generate returns, but the risk remains.

For instance, in crypto trading, if a trader has decided to buy Ether with a margin of 50%, then there is a chance of buying the asset and waiting for returns if the news around the cryptocurrency is positive and the price has been demonstrating green dynamics. If the trader bought $1,000 worth of Ether with a %50 leverage at $100 per coin, and the price rose by 2%, then the trader is in for a positive return of 2% and has enough leverage to pay off the broker. But as the market is quite volatile and the price is subject to swings, we can consider that the price suddenly fell by 12%, which means that the trader is now 12% in debt to the broker and will have to pay from his own pocket.

If we are to bluntly look at margin trading in a nutshell and consider the benefits that it brings to traders, then we have to consider the pros and cons on a weighted balance, since both are equal. The availability of liquidity cannot come without risks, but these are risks that every individual trader has to weigh depending on their financial standing, strategy, soundness of investments and other factors that will eventually lead to either returns or losses.

The fear of volatility has not only been keeping institutional investors and traders from partaking in crypto trade, but is also a limiting factor for millions of people from engaging in trade in general. The availability of capital determines much when deciding to engage in trade with assets that are unstable. But there is the possibility of trading on some platforms and exchanges that may not require margin trading in principle. The reason is not the lack of risk, but rather the availability of instruments that do not require the need to resort to margins.

Looking Back

After having read the brief explanation on margin trading with its main ins and outs, the reader will have probably understood that some terms on the trading market are not as scary as they are made out to be. In fact, as with most financial terms, operations that can be conducted even between friends or are common practice in banks, can migrate to the trading market and acquire new aspects, applications or monikers.

The main factors underlying margin trading are those of opportunity and risk. Both walk hand in hand down the path of market charts and graphs. The opportunity of buying assets of interest using loans is what margins are all about. They give liquidity under obligations to pay it back. The downside is the factor of uncertainty, as the asset purchased on margin can fall in price and turn the expectation of returns into losses, thus forcing the trader to pay back the margin from his own pocket.

Whatever strategy the trader resorts to on the market, the tools needed will be there on the MoonTrader platform and allow for ample opportunities of generating returns, when combined with sound approaches. And whatever the approach, we hope it’s profitable for our users!

Jump to: Part 1, Part 2, Part 3, Part 4, Part 5, Part 6, Part 7, Part 8, Part 9, Part 10, Part 11, Part 12, Part 13. Part 14.

Check us out at https://moontrader.com

Twitter: https://twitter.com/MoonTrader_io

LinkedIn: https://www.linkedin.com/company/19203733

Reddit: https://www.reddit.com/r/Moontrader_official/

Telegram: https://t.me/moontrader_news_en