Jump to: Part 1, Part 2, Part 3, Part 4, Part 5, Part 6, Part 7, Part 8, Part 9, Part 10, Part 11, Part 12, Part 13. Part 14.

Seize the chance: Trend reversal signal on the MACD indicator

The trend reversal point is the stumbling block of any trader. Dozens, if not hundreds, of various indicators and candlestick patterns have been created for its precise determination, because opening or closing a position as close as possible to the trend reversal point is the key to maximum profitability. The weakening of the pressure of the bulls or the bears is most effectively shown by the MACD indicator, or the Moving Average Convergence and Divergence.

What the moving averages speak of

The MACD indicator appeared on the exchanges in the 70s of the last century and served to identify the direction of the trend and momentum, or the intensity of price movement along the trend. This technical indicator has two varieties:

- MACD line indicator — trend (lagging) indicator;

- The MACD histogram is an improved version of the indicator designed to be ahead of the signals given by the MACD line. It can be called an oscillator and used to make trading decisions.

On most modern exchanges, these two indicators are combined in one chart:

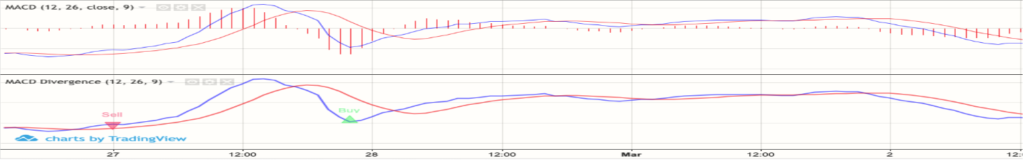

The value of the MACD indicator (blue line) represents the difference in values between the fast (period 12) and the slow moving average (period 26). This difference indicates the intensity of the trends. When the moving averages intersect, the MACD becomes zero. If the MACD is above the central level, the trend is considered to be upward, and if it is below, then it is downward.

The second line on the MACD graph (the red one) is the exponential moving average of the MACD line itself with a step of 9. It is also called the signal line. It gives an earlier signal to the trend reversal compared to the zero level of the MACD line. An MACD histogram is constructed based on the interaction of the MACD with the signal line. But we should not use a histogram to analyze stock prices, since they are derived from the linear MACD.

In pursuit of discrepancies

The discrepancies between the indicators of the MACD indicator and the price on the chart are called divergence and convergence, depending on whether the trend is bullish or bearish. They act as a powerful and reliable signal for opening or closing a position.

The most accurate are the divergences and convergences of class A. As a rule, they are followed by a steep reversal. Divergence A is formed when the rate updates the price maximum, however, the next indicator maximum is lower than the previous one. The reverse situation suggests a convergence of A, or a change in trend from bearish to bullish. And this is a signal to open a long position.

Divergence B indicates a weakening of the bull trend and its immediate correction. This signal is less reliable, since the price may have a reserve for further movement in the same direction.

Class B Convergence

In markets with high volatility, one can often observe class C divergence and convergence. This discrepancy suggests that there is a slight drop in momentum, and such signals should not be given significant attention.

As a rule, two vertices are analyzed to detect discrepancies. But in some cases, the price confirms its trend at the next extreme, and the indicator shows the opposite. Such a situation is considered to be an even more reliable signal for opening or closing a position.

It is also possible to track discrepancies directly inside the MACD index, which are an indicator of the intensity of development of a trend. Thus, the divergence of moving averages occurs when the distance between moving averages increases, and the price increases rapidly. Then the trend develops with greater speed. In this case, the MACD line is moving away from zero. The convergence of moving averages, on the contrary, occurs when moving averages approach each other. The impulse then subsides and the trend slows down. The MACD line is thus nearing zero.

Nevertheless, before drawing conclusions based on divergence or convergence, it is necessary to make sure that there is a clear trend developing on the market, since a large number of false signals may appear during the flat period. The more obvious the difference traced on the market, the greater the number of traders that will react to it, which increases the likelihood of a correct forecast. The probability of error always exists, and we recommend that you limit the risks by using stop orders.

Jump to: Part 1, Part 2, Part 3, Part 4, Part 5, Part 6, Part 7, Part 8, Part 9, Part 10, Part 11, Part 12, Part 13. Part 14.

Check us out at https://moontrader.com

Twitter: https://twitter.com/MoonTrader_io

LinkedIn: https://www.linkedin.com/company/19203733

Reddit: https://www.reddit.com/r/Moontrader_official/

Telegram: https://t.me/moontrader_news_en