The general concept: An algorithm designed to place orders based on signals received from Telegram channels. Our own Telegram bot connects to the user’s Telegram account, from there the user should set up channels that will provide signals, then our Telegram bot will pass them to the algorithm, which will place orders on the exchange according to the parameters described in the signal (TP/SL percentage, entry price, etc.).

Note: for the algorithm to work, you need to configure the channels in BotClient, from which you will receive signals. For details, see the BotClient configuration page.

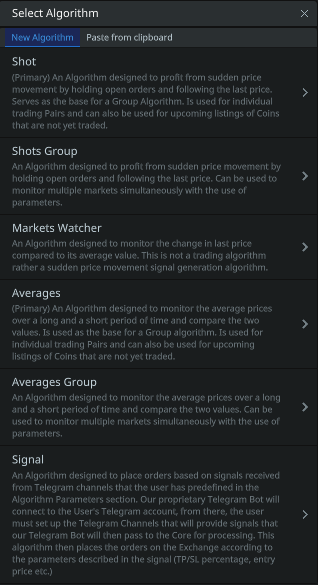

To add a new algorithm, click the Add algorithm button on the Algorithms tab. The following pop-up window will appear:

Consider the Signal:

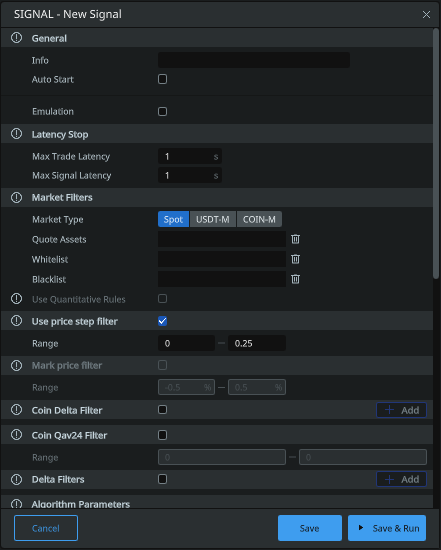

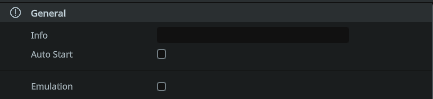

General

- Info: Specify the name of your algorithm so that you can easily identify it in the full list of algorithms. You can specify parameters in the name for convenience, for example — «1min/1sec-0.4/0.3-long».

- Auto start: the on/off switch allows the user to choose whether the algorithm will start automatically after the kernel starts.

- Emulation: if checked, the algorithm operates in «emulation» mode, without placing orders on the exchange. (In this mode, the reports do not take into account the commission, for the analysis you need to calculate yourself)

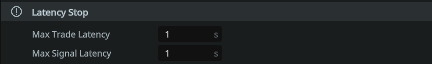

Latency stop

Stops the Algorism in Case of exeesive Trade Data latency. Values between 1-5 seconds are recommended. This serves as extra protection against exchange lags and unwanted order executions.

- Max Trade Latency: if the specified delay is exceeded, the algorithm will not work. Specified in seconds. 1 second = 1000 ms of delay.

- Max Signal Latency: (in seconds) if the delay between the signal publication and data receipt exceeds this value, the order will not be placed. Specified in seconds. 1 second = 1000 ms of delay.

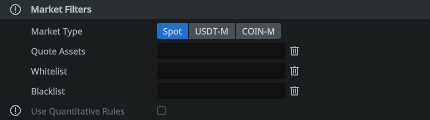

Market Filters

- Market type: allows the user to select the desired market type for trading: Spot/Margin/Futures/Quota.

- Quote assets: quoted asset (e.g. usdt or btc). If you want to trade the whole market to Tether currency, specify usdt and press Enter.

- Whitelist: «Whitelist» currency pairs. If you fill in this field, you should leave «Combined by Quoted Pair» blank! Suppose you want to trade only two pairs BTCUSDT and ETHUSDT, specify them in this field separated by commas. Other pairs will not be traded. The format is btcusdt, ethusdt, etc.

- Blacklist: «blacklisted» currency pairs. Suppose you specified the quoted asset usdt in the «Quoted Pair», but do not want to trade on currency pairs BTCUSDT and ETHUSDT, specify them separated by comma. The format is btcusdt, ethusdt, etc.

- Use quantitative rules: (For Binance only) includes protection from being banned under the category of quantitative rules. Read more on the Binance official website: https://www.binance.com/ru/support/faq/4f462ebe6ff445d4a170be7d9e897272

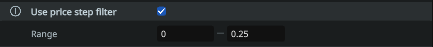

Use price step filter

- Range: (from and to, in absolute value) sets the algorithm interval for the price step as a percentage of the current price (if the price step is less or more than this percentage, the order will not be placed).

Mark price filter

- Range: sets the algorithm the interval of deviation of the marking price from the current market price (in percent) within which the order will be placed. IMPORTANT: it accepts RELATIVE values! That is, you can set both negative and positive values. Orders will be placed as long as the mark price is within the specified range.

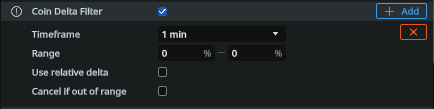

Coin delta filter

- Timeframe: the time interval of the delta, currency pairs (which will be selected, given the data of the quoted currency, «white list», «black list»). You can select one of the options — 1, 3, 5, 15, 30 or 60 minutes. In the future, the framework of the minimum and maximum delta of currencies, will be based on this interval.

- Range: Specify the range of the minimum and maximum delta. From N1% to N2%. If the delta of the asset is outside the selected range, the algorithm will not work and the orders will not be placed. For example, if you have selected a time frame of 5 minutes, and you specify a range of 0.5% to 2%, then the algorithm will trigger only on those pairs, on which the price has changed within 5 minutes, at most 2% and at least 0.5% — the price direction is not important. The values are only positive. You can see the deltas in the client — the «Market Watch» tab.

- Use relative delta: If checked, you must specify relative deltas in the «range» field. If negative, then with a minus sign (for example -1.4), if positive, you don’t need to specify the sign.

- Cancel if out of range: If the checkbox is checked, then when deltas leave the selected range, the orders in this algorithm will be canceled.

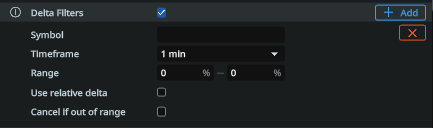

Note: you can add multiple filters with different deltas for a given type.

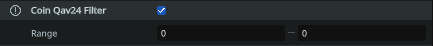

Coin qav24 filter

- Range: specify the range of minimum and maximum volume for 24 hours, of currency pairs (which will be selected considering the data of the quoted currency, «white list», «black list»). In case the volume of the chosen currency pair will be lower than the value set in the first field or higher than the value in the second field, the algorithm will not work and the orders will not be placed. You can see the volumes in the client — the «Market Live» tab.

Delta filters

- Symbol: The trading pair in relation to the delta of which the filter will be activated. For example BTCUSDT.

- Timeframe: The time frame of the BTC currency delta. You may choose between 1, 3, 5, 15, 30 or 60 minutes. Later on, the range of minimum and maximum delta of BTC will be based on this interval.

- Range: Specify the range of the minimum and maximum delta of BTC. From N1% to N2%. If BTC’s delta is outside the selected range, the algorithm will not work and orders will not be placed on the selected pairs. The values are only positive. You can see BTC deltas in the client — «Market Watch» tab.

- Use relative delta: if checked, then relative deltas must be specified in the «range» field. If negative, then with a minus sign (for example -1.4), if positive, you don’t need to specify the sign.

- Cancel if out of range: If the checkbox is checked, then when deltas leave the selected range, the orders in this algorithm will be canceled.

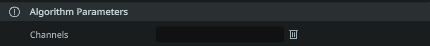

Algorithm parameters

- Channels: specify the names of the channels from which you want to receive signals for this strategy.

Note: for the algorithm to work, you need to configure the channels in BotClient, from which you will receive signals. For details, see the BotClient configuration page.

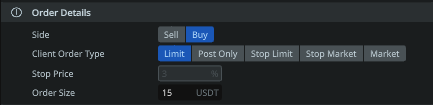

Order Details

- Side: allows the user to select which type of order to place to the algorithm Buy (Long) or Sell (Short).

- Client order type: sets the type of order, which will be placed by the algorithm. You can read more about the type of order in the documentation of the Exchange.

- Stop price: sets a certain distance from the price level at which the stop-limit order is placed to the price which triggers the stop-limit order.

- Order size: The value of the order set in USDT. This value takes into account the user’s leverage. For example, to trade on the BTCUSDT pair, the minimum order size is 0.001 BTC, at a BTC price of $45,000, it will be $45. It is necessary to specify from 45, this value will already be with a leverage, i.e. at a leverage of x125 — your means will be involved 0,36$. Try to specify a little higher than the minimum value for the correct execution of the order.

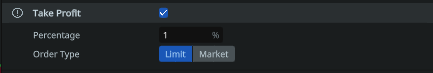

Take profit

- Percentage: Sets the distance from the price (at which the order was executed) to the Take Profit in percent.

- Order type: Sets the type of Take Profit order to be placed by the algorithm. You can read more about the order type in the documentation of the Exchange itself.

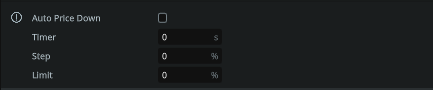

Auto price down

- Timer: sets the delay in seconds until Take Profit starts to decrease to the current price (the same value will be used for the first step as well as for all subsequent steps).

- Step: Sets the percentage value of the step of approximation of Take Profit to the starting price.

- Limit: Sets the lowest limit in percentage of the initial order, up to which Take Profit will decrease and stop.

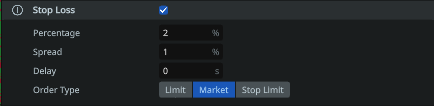

Stop loss

- Percentage: Sets the distance from the price (at which the order was executed) to the Stop Loss as a percentage.

- Spread: allows the user to set the distance in percent of the current price that will determine where the Stop Loss will be placed once the price crosses the stop trigger.

- Delay: sets the delay in placing a Stop Loss in seconds after an order has been executed.

- Order type: Sets the type of Stop Loss order to be placed by the algorithm. You can read more about the type of orders in the documentation of the Exchange itself.

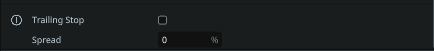

Trailing stop

- Spread: the value in percent of the price movement, in the opposite direction from the initial price. At which Stop Loss will follow the current price at a specified distance in the «Stop Loss -> Percentage» parameter.