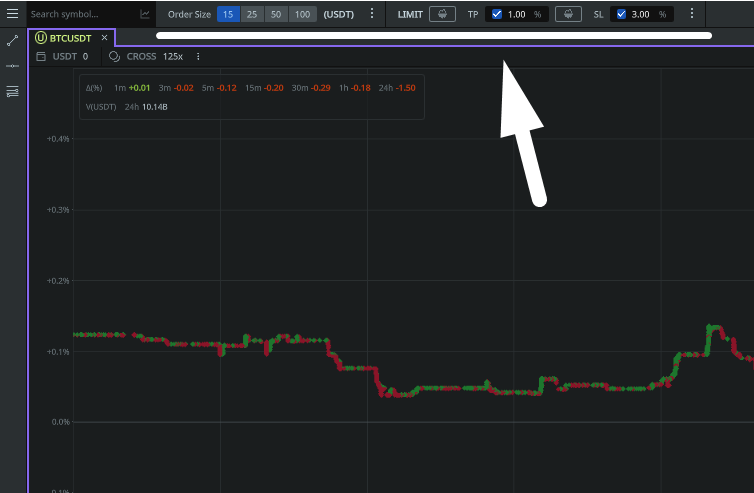

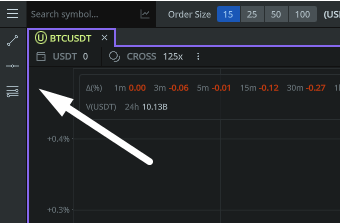

In addition to algorithmic trading, MoonTrader also has the ability to trade manually. You can find the basic settings at the top of the main screen.

For quick access, this panel contains the most basic settings.

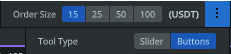

Order size

In this menu you can choose the type of display. It can be different orders presented in the form of buttons or a slider, where the size as a percentage of the open market deposit is set.

To change the order size — double click with the left mouse button.

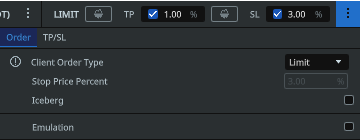

Basic order settings

- Client order type: sets the type of order to be placed by the algorithm. You can read more about the type of orders in the documentation of the Exchange itself.

- Stop price percent: sets a certain distance from the price level at which the stop-limit order is placed to the price which triggers the stop-limit order.

- Iceberg: Choose «Iceberg» to hide 90% of the volume of your order when placing it in the order book (recommended when working with order sizes larger than 5000 USDT, this feature only works on SPOT markets)

- Emulation: If checked, manual trading works in «emulation» mode without sending orders to the exchange. (In this mode the commission is not considered in reports, for the analysis it is necessary to calculate by yourself)

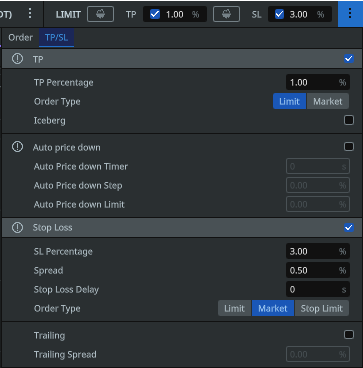

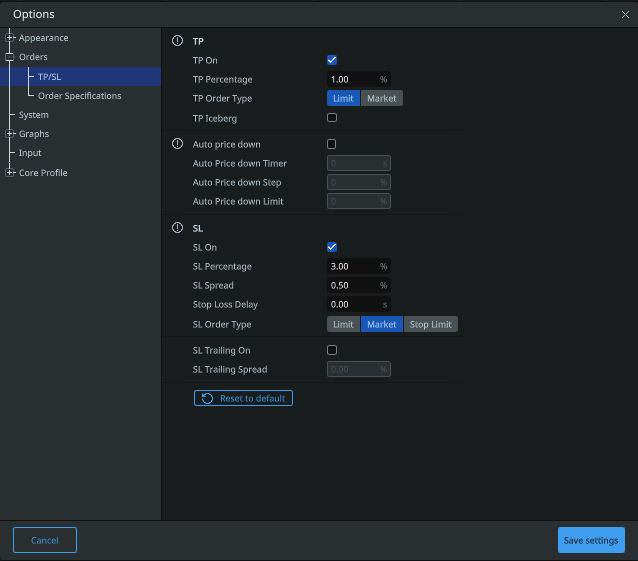

TP/SL settings

General Take Profit settings for Manual trading. It is advisable to use a combination of Limit Take Profit and Market Stop Loss. Select the «Iceberg» option to hide 90% of your order’s volume when placing them in the order book (advisable for orders over 5000USDT, this option works on the SPOT market only). Use the TP auto price down feature by setting a timer, in seconds, for the gradual movement of the order closer to the entry price, having set the step for each movement in % and a limit, i.e. a threshold relative to the entry price (can take both positive and negative values), at which the movement will stop.

- TP percentage

- Order type

- Iceberg

Auto Price-down functionality that allows the Take Profit to start moving towards the openning price, starting from the initial value set in the Take Profit section towards a Limit (%) in preset Steps (%), each step taking a period of Time set in seconds (Timer)

- Auto price down timer

- Auto price down step

- Auto price down limit

General Stop Loss settings for Manual trading. It is advisable to use a Market type Stop Loss for all orders under 5000USDT and their equivalent, and a limit type Stop Loss for larger orders. The Stop Limit order type changes the logic of the Take and Stop order pair and if chosen, will place a real Stop Loss order on the exchange during the trade. The Spread parameter is used for both Limit and Stop Limit options and is used to avoid price slippage; the bigger the value of the parameter, the lower the actual order to close the trade using the Stop Loss will be placed from the trigger price. Trailing SL — the feature allowing the Stop Loss to trail the price into the «no-loss» area in the event of a positive price movement, the Stop Loss will move only if the current price is further from the SL than the SL trailing Spread.

- SL percentage

- Spread

- Stop loss delay

- Order type

- Trailing

- Trailing spread

Other settings

In addition to the settings panel on the main window of the terminal, it is possible to configure through the main settings of the MoonTrader.

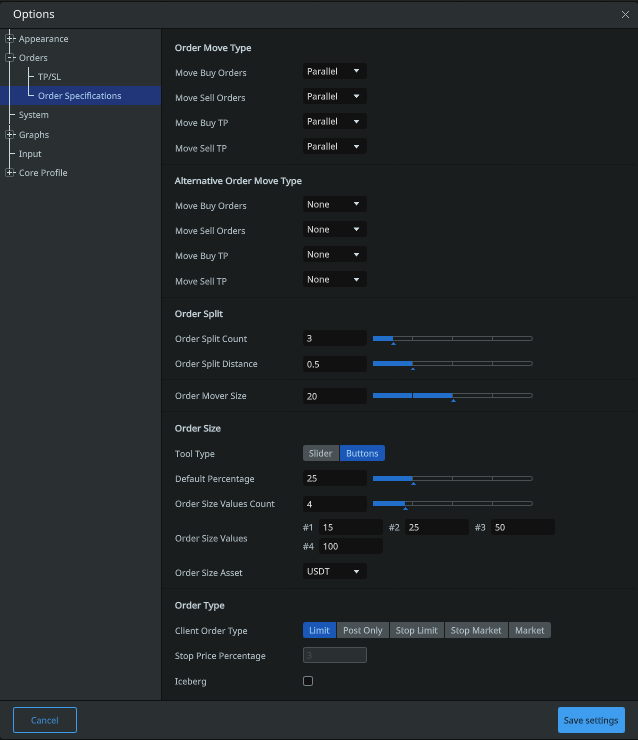

Order specifictions

Additionally, you can set up the main and the alternative method of promotion. If you have a lot of orders and need to move them all at once in one price via hotkeys, this can be configured. You can also define the number of parts and the distance between them when splitting a large order. (To merge and divide orders, it is enough to right-click on the order itself on the chart). There is also an opportunity to add a number of buttons for orders and set values «by default».

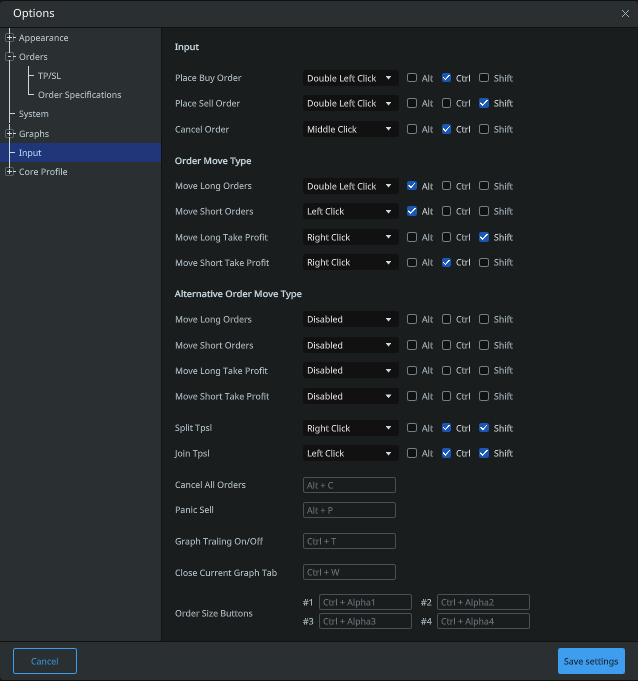

Input

Drawing elements

If you need to draw horizontal or inclined levels, as well as stretch the Fibonacci grid, these drawing elements are in the left field of the terminal.

Note: a more detailed description of the settings functionality, you can find in the «Basic Settings» section.