Jump to: Part 1, Part 2, Part 3, Part 4, Part 5, Part 6, Part 7, Part 8, Part 9, Part 10, Part 11, Part 12, Part 13.Part 14.

There’s An Order For Every Case Out There

If we regard the crypto market as a novel, then it would be appropriate to start such a novel much like Charles Dickens’ David Copperfield with the words “I am born”. But the novel would be rather short-lived if we look at the way the main character of the novel has matured, as most cryptocurrencies have been falling in value and the ever-so popular Hodl strategy of 2017 is long dead and buried in the crypto cemetery.

The time has come to rally to the banner of a completely logical and more profitable evolution of the crypto market, which is trading and generating liquidity through operations and orders. The sad fact is that most participants on the crypto market do not known how to trade and the myriad trainings available on the internet are more of a confusion than a real aid. The crypto trading market is not that different from the traditional market of stocks and commodities, as the tools present on both are nearly identical. No matter how various experts and enthusiasts try to twist the concept of crypto market uniqueness, the main instrument generating trade is still the order, which has successfully migrated from conventional markets into the crypto environment.

This is why we at MoonTrader are seeking to provide the necessary training and education beginning traders need to abandon the hopeless cause of the hodl strategy and start generating revenues from their assets through trading.

To begin the introductory course, we shall consider the types of orders relevant for most other exchanges using the example of the Binance Exchange website. The orders themselves are divided into three types by nature of execution: market order, limit order and stop order.

All of these orders have additional opportunities inherent to them, which are intended to limit risks and automatically complete transactions. The Stop Loss orders will help minimize risks during a price drop and will try to reduce losses to zero. As for making profits, professional traders use the Take Profit order.

Stop Loss First, And Then Take Profit

The Stop Loss and Take Profit are pending orders that are triggered when the asset’s price passes certain levels. When placing such orders, traders limit the size of their profits and losses. Pre-set Stop Loss and Take Profit levels allow traders to complete a transaction automatically without having to constantly monitor exchange rate graphs that most novice traders find utterly incomprehensible.

The most reliable levels for setting Stop Loss orders in the long run are strong support levels. As for Take Profit, resistance levels prove to be more reliable. Some traders place such orders below or above the moving average lines (MACD index), as most exchanges present these on their charts. For intraday trading, the option of setting a “short” stop-loss is often used. This is when an order is placed at a minimum of the previous candle, or the bar that indicates changes in prices on graphs in understandable green and red colors.

To place pending orders, traders need to determine when their order price is reached in the orderbook, as well as what rate it will be placed at. For instance, if we set a limit of $3,350 for BTC, when this price is reached, the order will appear in the orderbook not at $3,350, but at $3,355 or $ 3,360 depending on how the trader decides.

Trailing Stop Loss

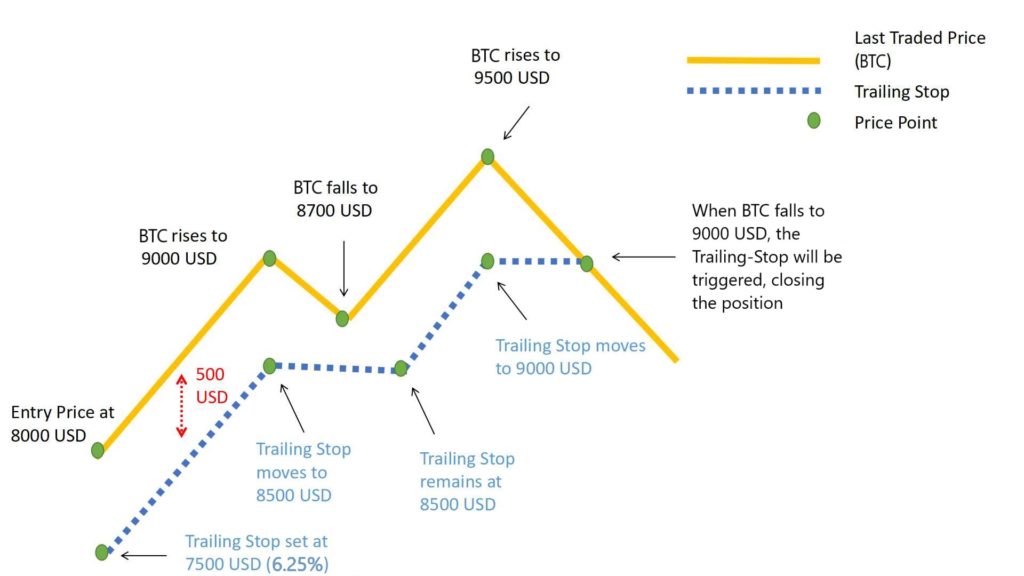

Trailing Stop Loss is a type of Stop Loss order which will be available in MoonTrader. Under this type of order, the price level that serves as a signal for placing an order in an orderbook changes in accordance with the exchange rate. The Trailing Stop Loss order allows traders to minimize risks when the price moves in the direction of the forecast they have made.

For instance, if we set 6.25% as a stop level, which corresponds to $7,500 for BTC with a base price of $8,000, then the bar will always be kept at a distance of $500 from the current price as the market grows, closing your order whenever BTC will drop by $500, and subsequently, generating profit.

Mastering trading is something that virtually every participant of the crypto market has to undertake, given that waiting for miracles is off the table. The instruments are all there and so is the knowledge base necessary to start working on the market. Certainly, it is necessary to take precautions and be mindful of the risks associated when trading, but with enough experience and the necessary trading platform, it is possible to start earning serious money on the crypto assets available. A dollar here and a few cents there is the principle by which traders work, and if taken in aggregate over a period of time, such small daily victories will amount to a hefty sum of profit.

Trading is an art form that needs to be acquired like taste for good wine. That is why we welcome everyone to our blog where we will go on posting educational articles on the art of trading, as well as our constantly growing community. One can never have too much money, or too many good friends, and we will certainly help you make more money while making more friends on our channels!

Jump to: Part 1, Part 2, Part 3, Part 4, Part 5, Part 6, Part 7, Part 8, Part 9, Part 10, Part 11, Part 12, Part 13. Part 14.

Check us out at https://moontrader.com

Twitter: https://twitter.com/MoonTrader_io

LinkedIn: https://www.linkedin.com/company/19203733

Reddit: https://www.reddit.com/r/Moontrader_official/

Telegram: https://t.me/moontrader_news_en